How much do you pay for car insurance for your Rav4 and which company are you using

What is your auto insurance premium and what company do you use?

I have no bad history and StateFarm raised my rate from $112.00/month to $151.00/month.

I’ve been working in SF since 2012, so I don’t know what my options are when it comes to insurance.

Progressive quoted me $86.00.

Feedback Wanted I really want companies to be honest about their rates and can’t do that without comparing.

I live in East Texas! I know there are big regional differences.

I have a Progressive company in California and am very happy with their service. I moved here from Mercury Insurance. Stay away from them. Mercury is a joke.

I am 18 years old and I got full coverage for only $98.

Because the insurance is based on statistics of collisions with this vehicle, and they make almost 700,000 of them for the North American market alone, there are a lot more collisions than other vehicles, plus the rav4 is one of the tops on the list of stolen vehicles, and there are a lot of people around that should have their license/bad drivers, because for the most part they group us all together, and it makes a difference where you live, the more people there are! The higher the insurance rates.

Interesting. That might explain why my new 22 Subaru Ascent is cheaper to insure than my 2018 Rav4.

Yeah, fewer cars on the road and the algorithm in their software says it’s cheaper! Joke’s on you, there is no data on the car behind this, just a computer program doing the work.

How much for Rav4 Car Insurance

Geico insurance in Southern California is $126.83/month. 2019 rav4 AWD XLE Gas

I called them all and GEICO had the highest price.

I have USAA and pay $117 for a 2021 RAV4 XLE in Southern California with no bad history and a $500 deductible.

GEICO is paying $185 a month for both vehicles!

We pay $293.20 for full coverage on both vehicles.

This is their replacement value. How much would it cost to replace this vehicle compared to your old vehicle?

From $98 (Jeep) to $112 (RAV4 Plus).

It jumped again to $151 because of a “new surcharge they have no control over”.

In WA, the price went up because credit scores are no longer allowed to be a determining factor, so prices went up for people with good credit and down for people with bad credit.

My 2013 rav4 AWD is $100/month in WA. Oddly enough, my 2022 Mach E AWD is also only $80/month in Seattle.

Progressive is also the cheapest for me.

I had a DUI 7 years ago (I don’t think it’s technically expunged from my record, but I don’t know if it affects my rates), but I’m fully insured with Progressive for $90/month after 4 years. Unfortunately, in the new area where I live now, the premium went up to $110/month, but such is life. Other than the DUI, I don’t have any other problems on my record.

I’m in Southeast Texas and I also have State Farm. When they raise my insurance rates I call and tell them I’m switching and they always find some discount.

It varies a lot from state to state. The answers you get here don’t work.

I would get an independent insurance agent and have them shop around for the best options.

In NC, Progressive full coverage on a 2021 RAV4 is $635 a year.

Gosh …… We pay $92 a month for full coverage on a RAV4 and a Corolla.

I work for State Farm Insurance (State Farm) and pay $48 per month for full coverage on a 2021 Rav LE.

NC Farm Bureau, full coverage $97.53 per month. turning 21 in December, no accidents or tickets. 2018 LE

Yeah, State Farm did the same for us.

Just got a quote for my 2020 Rav4 for $89 with a $500 deductible for full coverage.

Me too! I’ll be shopping for another policy before the end of next month.

I’ve had insurance in Erie for 3 years now …… No problems so far.

A coworker at my office referred me to Erie and I was relieved that no other insurance company could match the price given my new car and driving record.

I also got insurance from Erie and paid 113 full premium.

It’s great …… But you can lower your premium further depending on your driving and tides …… My premium is $500 a year …… Under the $1000 deductible plan, it’s closer to $42 a month.

State Farm is consistently one of the worst rated companies in my experience. My husband and I have had absolutely no tickets, accidents, etc. and their premiums are 3 times what we pay now. We have Connect Insurance through Costco. It is by far the cheapest insurance available. Maybe it’s time to find a new company?

The longer you stay with one insurance company, the more gouger they get! Shop around. Safeco and Progressive have been offering great rates lately. If you find an insurance broker, they will shop around for you.

Your state makes a big difference!

I’m in Maryland. I have a 21 gas XLE and I’m only 21 with 3 1/2 years of driving experience. I just moved into my own place and am using my own insurance to get away from my parents and my rate is $144/month which includes a rental discount. If I had my own place my rate would be $120.

Personally, I wouldn’t go with Progressive Insurance because they did a very slick bait and switch on my boyfriend. They gave him a good rate and then raised it almost 60% on his first renewal. He also has a clean record.

I’ve been with State Farm insurance since I got my license; spotless driving record, zero claims (except for two on glass), but I had to leave; full coverage rates on a ’22 RAV4 XLE and a ’14 Avalon were close to $200 a month. I went to Progressive and got the rate down to $134. Apparently where you live has a big impact on rates – we live in rural Tennessee.

Progressive sucks! Little coverage and high rates. Also, they raise your payment after 6 months even if you haven’t had an accident. After switching to Geico, I have full coverage, including gap insurance, towing, roadside assistance, and it’s cheaper. After the first 6 months with them my payment dropped $40. Try getting a quote online, it’s quick and easy and only takes 10 minutes.

It depends on age, location, mileage driven to work, etc. and some people have multiple cars and homeowners insurance.

State Farm is horrible – try Geico. they saved me a lot of money.

Better rates, but reliable …… Sometimes not the clearest.

21 XSE I have farmers that pay $115 a month in SC.

for two vehicles for 6 months is $112. ($655 of that is for the RAV).

I pay $101.00 with Geico in Illinois. 2019 Rav4 XLE

They did the same for me when I traded in my 2020 RAV4 XLE for a 2022 RAV4 XLE Hybrid. No accidents, no criminal record. I was paying 112 exactly the same as you do in Corpus Christi, TX before and after switching vehicles and they charged me $145. Then switched to Progressive with similar coverage for $125.

Try Geico, I have full coverage for my 2020 Rav4 xle and liability for my Honda Civic for $156 a month.

Cars are ridiculously overpriced and cost more to replace.

Never had an accident since 1987

113 fully insured 2022 rav4 xle insurance at 25

I’m having some issues with State Farm …… They gave me a lower quote on my new 22 Subaru Ascent compared to a 2018 Rav4. I have a good driving record and also have homeowners insurance with them. They said they were in the process of re-quoting. The insurance for the Ascent was $81.51 and the Rav4 was $94.15.

At State Farm, insurance for two vehicles and two drivers is $195 per month.

The 2021 Tacoma and 2021 RAV4 Hybrid cost $108/month to insure at USAA. Although my coverage is ridiculously high, before I put everything into my LLC.

Progressive is great. Claims are paid quickly.

Progressive has three drivers (one minor) and four vehicles, two of which have state minimums and roadside service. We have an 03 echo, 05 rav4 sport 2wd, 05 corolla, and 05 mazda mpv. the echo costs the most and we pay $154 a month in california.

But it’s impossible to compare because no two drivers are the same, addresses are different, etc.

That’s cheap, my car insurance is over $350 and I’ve never had an accident in the last 7 years (since I got my US license) and I drove all over the world before immigrating here, but …… They are charging me high rates because I have no driving record here (of course I just immigrated) but I have driven on the roads of Europe and Asia, crazy huh?

I don’t recommend Geographic Insurance, they did the same thing to me in Arizona. My new rate when I bought the car was $88/month, 2 years later they raised my rate to $140/month and my driving record is clean for a 19′ rav4 single. I am still looking for a better rate at this time.

Geico offers $70 coverage for 2 people with a clean driving record and there are many factors included in the monthly premium.

In my budget, insurance is one area where I am willing to pay a little more because I know I have a reliable agent who will advocate for me when needed. I’ve also found that the cheapest up front is not always the cheapest in the long run. To answer your actual question, there are a lot of factors that go into determining rates other than the type of vehicle.

I pay $177 per month for a 2022 rav 4 XLE premium hybrid and a 2015 Chrysler 200 with full coverage. Comprehensive is $250 and collision is $500. Not sure how much they are each, I’ll have to look.

I have Geico insurance and pay $294.90 for 3 vehicles. My 18 RAV4 is the only one with full coverage.

Conclusion

Price does not always equal coverage. I take a finance class and we talk about the amount of coverage you want, not the cost, but once you have the right amount of coverage, you can then go back and compare prices for the same amount of coverage. This is just a thought as I don’t want to see you buying a new car for a discount.

Side note: When I moved from Michigan, I saved $500 a year. So, different states will have different rates as well.

As a result, I’ve spent the last two weeks shopping for insurance. Here are the tips I used, in case you’re interested.

- 1. don’t use those insurance apps like Otto, Jerryapp and Ais. i tried all three and found them to be a waste of time. They all call you spam. Spam you. And they all give you the most outrageous quotes.

- 2. Google the best insurance companies in your city and state. 3.

- 3. Call 5 major insurance companies. Like State Farm, Allstate, Progressive, Geographic, AAA. All quotes use the same coverage. 4.

- 4. I got quotes ranging from $450-$1600 for 6 months.

I know it’s crazy, but I’m happy with $450.

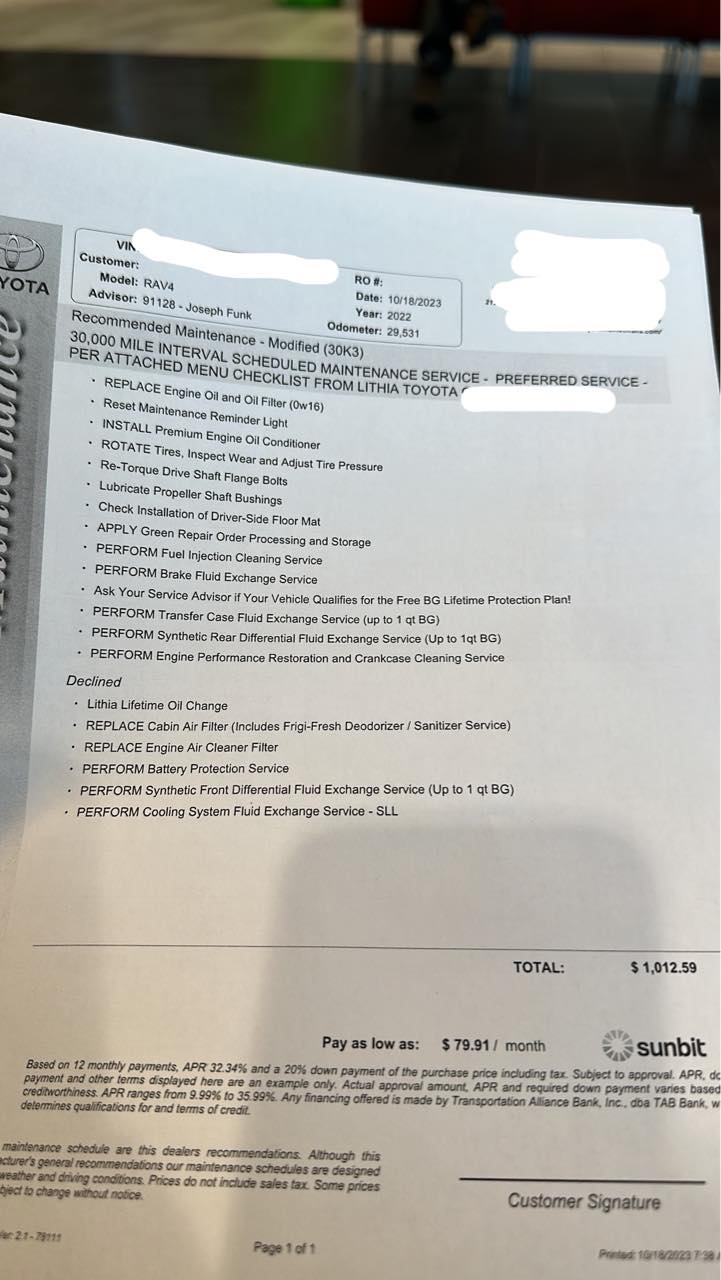

Quote for a 2022 rav4 hybrid xle.

Deductible for collision and comprehensive both $1000.

Full glass repair $0.